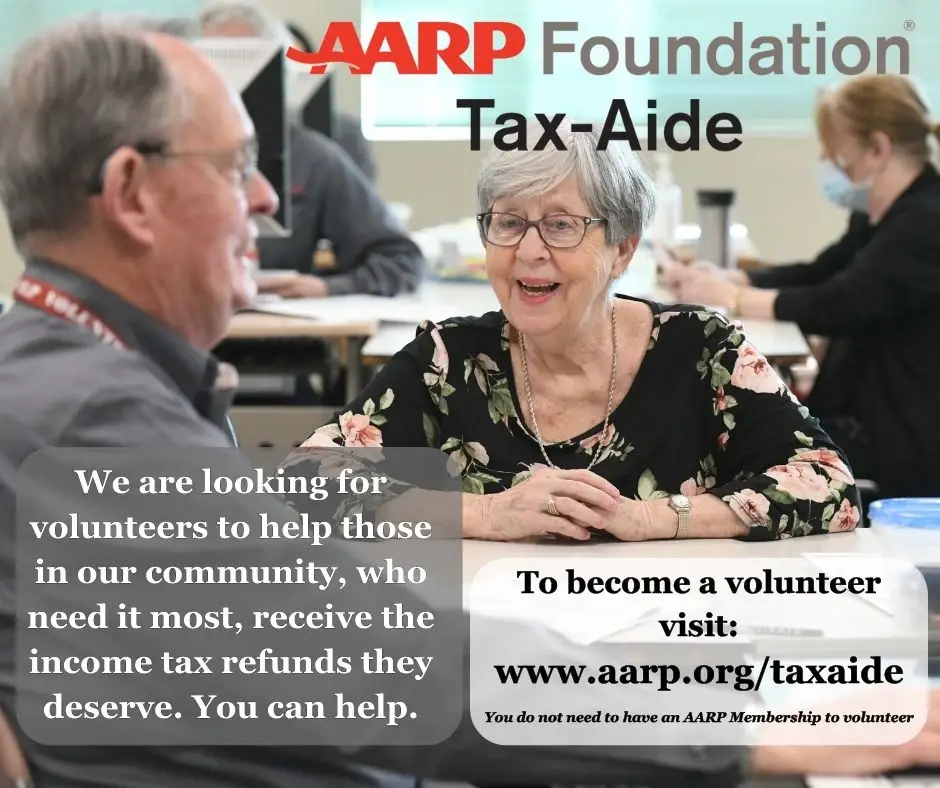

Nonprofit

Tax Counselors/Preparers

Details

Description

Ø The Tax Counselor provides tax assistance and preparation service to taxpayers. They prepare federal returns and/or answer questions to the extent of his/her current tax training and certification at assigned tax assistance sites. All Tax Counselors are certified at the IRS Advanced Level through online testing. Every site has a Local Coordinator to oversee operations.

Ø For New Tax Counselors training is an eight-day commitment during January. This year orientation is January 7 & 8 2026 (Tues-Wed) and tax law training is January 12-15 (Mon-Thurs) at the Palm Coast Community Center. Friday the 17 th is at Flagler Beach United Methodist Church and will include all of the returning counselors. There is a lot to learn! You will learn about tax law, the software, the Chromebook, intake & interview skills, general policies/procedures and some case studies. After the first year the training is less than the initial training and you can do most of it at home. During training you will complete the IRS Advanced Test and start the four tax return problems. There is some online AARP Tax Aide training on policies/procedures that can be done in advance. Can’t attend all of the training? Please still reach out to discuss other options.

Time Commitment during Tax Season: All our volunteers are assigned to a specific site at least one full day a week, if you have a conflict during the season (vacation or doctors’ appointment) - other volunteers can substitute for you. The tax season is from February1st-April 15th.

To register directly go to aarpfoundation.org/TaxaideVolunteer.

Location

Flagler County Sites

Directions

6 Sites in Flagler County available to volunteer at.

Please fill out this form